Confronted with stiff competitors within the U.S. housing market over the past 12 months, dwelling patrons upped their down fee to succeed in a report of $66,000 in Could, in keeping with a brand new report.

Down funds peaked in Could, hitting a nine-year excessive, the place the everyday down fee was 18% of a house’s buy value, a report from real-estate brokerage Redfin discovered.

In Could and June, the everyday purchaser was placing down $66,000, Redfin mentioned

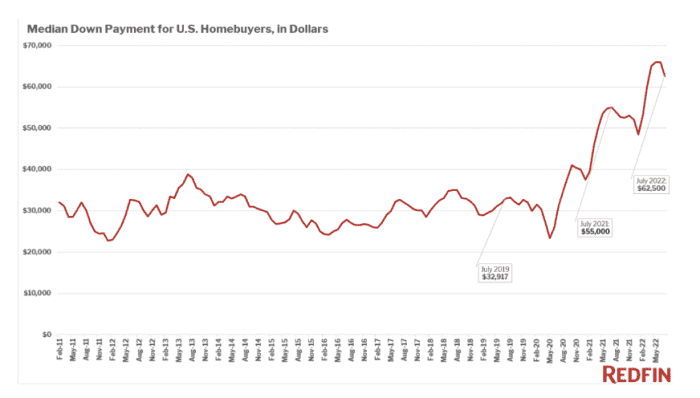

However that quantity has cooled barely since. Redfin additionally mentioned that the everyday U.S. homebuyer who took out a mortgage in July 2022, made a $62,500 down fee.

That’s nonetheless up 13.6% from a 12 months in the past. And in comparison with the median quantity individuals had been placing down earlier than the pandemic in July 2019 of $32,917, the everyday down fee doubled.

Practically 60% of patrons who had taken out a mortgage had put down greater than 10% down fee, which was up from the 50% vary earlier than the pandemic.

(Redfin)

5 cities the place down funds rose probably the most

Out of the highest 5 metros the place down funds rose probably the most, the East Coast dominated the listing.

Down fee greenback quantities rose probably the most in Nashville, Tenn., by practically 40% from a 12 months in the past. The everyday down fee was $64,250 in July.

That’s adopted by these 4 cities:

- Newark, N.J. – typical down fee was $90,000 in July, up 36.4% from a 12 months in the past

- New York Metropolis, N.Y. – typical down fee was $197,875, up 34.8% from a 12 months in the past

- New Brunswick, N.J. – typical down fee was $90,000, up 34.3% from a 12 months in the past

- Charlotte, N.C. – typical down fee was $48,200, up 32.6% from a 12 months in the past.

However down funds fell in lots of cities within the U.S., significantly out west.

Down funds fell probably the most in Riverside, Calif., by 15.4% from a 12 months in the past, to $55,000.

Folks had been additionally placing down much less in San Francisco, at $364,000, down 7.8% from a 12 months in the past.

Oakland, Calif., Warren, Mich., Detroit, Mich. and Seattle, Wash. adopted.

When it comes to percentages, the everyday dwelling purchaser in Denver was probably the most aggressive, placing down 20% down in July, in keeping with Redfin.

That’s up from the everyday Denver purchaser placing down 15% a 12 months in the past.

Anticipate down fee quantities to return again down

Greater mortgage charges are partly the explanation why down funds have decreased.

“Greater month-to-month mortgage funds and the rising price of different items and providers minimize into patrons’ budgets, making it tougher to provide you with big down funds,” Redfin mentioned.

Redfin on Wednesday additionally added a characteristic which reveals customers down fee help info, hooked up to dwelling listings, on its web site. For-sale listings on Redfin in future will embody packages within the space that potential dwelling patrons can faucet on for down fee help.

However a slowing housing market signifies that individuals don’t must put down massive down funds to win bids on properties, Redfin famous.

“Homebuyers don’t must make monumental down funds anymore as a result of they’re a lot much less more likely to encounter bidding wars now that so many Individuals have bowed out of the market,” Sheharyar Bokhari, senior economist at Redfin, mentioned in a weblog publish.

So “whereas down funds will possible stay elevated above pre-pandemic ranges, they’ll in all probability fall a bit within the brief time period,” he added.

Bought ideas on the housing market? Write to MarketWatch reporter Aarthi Swaminathan at aarthi@marketwatch.com

Originally published at San Diego News HQ

No comments:

Post a Comment